Most buyers focus intensely on the house itself. Bedrooms, finishes, layout, and upgrades dominate attention. But long-term satisfaction often has less to do with the house and more to do with the immediate block around it.

Most buyers focus intensely on the house itself. Bedrooms, finishes, layout, and upgrades dominate attention. But long-term satisfaction often has less to do with the house and more to do with the immediate block around it.

Micro Location Matters More Than You Think

Two homes in the same general area can feel completely different depending on their exact location. A home near a neighborhood entrance may experience more traffic. A property backing to open space may feel quieter. Corner lots, cul de sac positions, and homes near shared amenities each create a different daily experience.

Observe the Rhythm of the Street

Visit multiple times of day. Morning routines, afternoon parking patterns, evening noise levels, and weekend activity can reveal the personality of the block. Are people outside? Are vehicles consistently parked along curbs? Do neighbors maintain exterior spaces? These subtle signals shape your lifestyle.

Future Development Signals

Look for vacant lots, aging structures, or visible renovation activity nearby. These clues may suggest future construction or revitalization. Understanding whether the block is stable, transitioning, or heavily improving can help you anticipate long term value shifts.

Community Chemistry

Block level culture matters. Some streets are quiet and private. Others are socially active and connected. Neither is right or wrong. The key is alignment with your personality and daily habits.

When you purchase a home, you are also choosing the environment directly outside your front door. Evaluate the block with as much care as you evaluate the kitchen. Satisfaction often lies just beyond the property line.

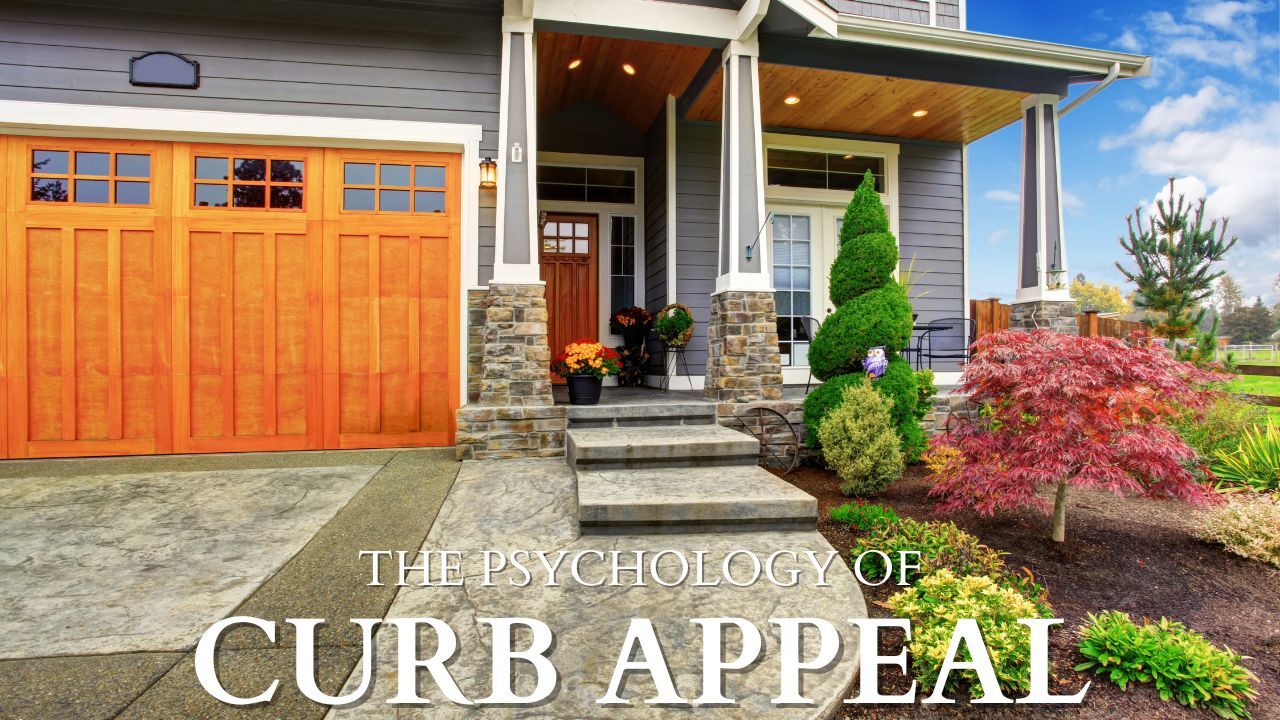

Curb appeal is often discussed in terms of landscaping, fresh paint, and updated fixtures. While those elements matter, the deeper principle at work is perception management. Exterior presentation shapes emotional response before a buyer ever crosses the threshold. By the time the front door opens, an opinion has already begun forming.

Curb appeal is often discussed in terms of landscaping, fresh paint, and updated fixtures. While those elements matter, the deeper principle at work is perception management. Exterior presentation shapes emotional response before a buyer ever crosses the threshold. By the time the front door opens, an opinion has already begun forming.

Many buyers delay decisions while waiting for a home that checks every box. While patience is valuable, perfection often creates paralysis. Understanding the difference between standards and unrealistic expectations helps buyers move forward with confidence.

Many buyers delay decisions while waiting for a home that checks every box. While patience is valuable, perfection often creates paralysis. Understanding the difference between standards and unrealistic expectations helps buyers move forward with confidence. Many buyers start their search with a specific number in mind. Square footage. While size matters, it is rarely the deciding factor in long-term satisfaction. How space functions often matters far more than how much of it exists.

Many buyers start their search with a specific number in mind. Square footage. While size matters, it is rarely the deciding factor in long-term satisfaction. How space functions often matters far more than how much of it exists. Most buyers expect an instant emotional reaction when they walk into the right home. The idea of love at first sight is common, but in reality, many of the best homes do not create fireworks immediately. They create possibility, and that is often quieter.

Most buyers expect an instant emotional reaction when they walk into the right home. The idea of love at first sight is common, but in reality, many of the best homes do not create fireworks immediately. They create possibility, and that is often quieter.

With rising utility costs and growing awareness around sustainability, many homeowners are looking for practical ways to improve energy efficiency. One of the most effective first steps is scheduling a home energy audit. A home energy audit is a professional evaluation of how your home uses energy and where improvements can be made to reduce waste, lower costs, and enhance comfort.

With rising utility costs and growing awareness around sustainability, many homeowners are looking for practical ways to improve energy efficiency. One of the most effective first steps is scheduling a home energy audit. A home energy audit is a professional evaluation of how your home uses energy and where improvements can be made to reduce waste, lower costs, and enhance comfort. When preparing to sell a home, homeowners have several paths to consider. One option that is becoming increasingly common is selling a property as-is. This means the home is listed and sold in its current condition, without the seller completing repairs or renovations before closing. While this approach can offer convenience, it is important to understand both the benefits and potential trade-offs before making a decision.

When preparing to sell a home, homeowners have several paths to consider. One option that is becoming increasingly common is selling a property as-is. This means the home is listed and sold in its current condition, without the seller completing repairs or renovations before closing. While this approach can offer convenience, it is important to understand both the benefits and potential trade-offs before making a decision. In the ever-evolving landscape of real estate, an increasing number of investors and homebuyers are recognizing the importance of sustainability and eco-friendliness. Green real estate, which encompasses properties designed with a focus on environmental efficiency and resource conservation, is gaining prominence as a smart and responsible investment. This blog explores the key aspects of green real estate and why it is becoming an attractive option for consumers.

In the ever-evolving landscape of real estate, an increasing number of investors and homebuyers are recognizing the importance of sustainability and eco-friendliness. Green real estate, which encompasses properties designed with a focus on environmental efficiency and resource conservation, is gaining prominence as a smart and responsible investment. This blog explores the key aspects of green real estate and why it is becoming an attractive option for consumers.