Sellers often assume buyers focus on square footage and finishes alone. In reality, buyers observe far more during a walk through. They are assessing condition, functionality, layout efficiency, and overall care. Understanding what buyers truly notice allows sellers to prepare strategically and avoid surprises during negotiations.

Sellers often assume buyers focus on square footage and finishes alone. In reality, buyers observe far more during a walk through. They are assessing condition, functionality, layout efficiency, and overall care. Understanding what buyers truly notice allows sellers to prepare strategically and avoid surprises during negotiations.

Condition Signals Maintenance History

Buyers look closely at visible maintenance cues. Cracks in walls, worn flooring, outdated fixtures, and water stains raise immediate concerns. Even if issues are minor, they can create doubt about hidden problems. Addressing maintenance items before listing reassures buyers and reduces the likelihood of inspection-related negotiations later.

Layout Efficiency Matters

A home does not need to be large to feel comfortable. Buyers evaluate how space flows from room to room. Narrow hallways, awkward furniture placement, or blocked sight lines can make a home feel smaller than it is. Simple adjustments, such as repositioning furniture or removing bulky pieces, can dramatically improve perception.

Storage and Functionality Influence Decisions

Closet space, pantry organization, and garage condition often impact buying decisions more than sellers expect. Buyers open doors and cabinets. They imagine how their belongings will fit. Clean, organized storage areas communicate practicality and livability.

Noise and Environment Are Observed

Buyers pay attention to neighborhood sounds, natural light exposure, and privacy levels. These elements shape long-term comfort. Being transparent about environmental factors builds trust and credibility.

Emotional Response Drives Offers

Beyond the practical evaluation, buyers rely heavily on emotional response. A clean scent, welcoming entryway, and cohesive design create positive impressions. Homes that feel cared for encourage stronger emotional connection.

Preparing for what buyers truly notice strengthens your position in the market. When details are handled proactively, you reduce friction and increase confidence during negotiation. If you are preparing your property for market and want guidance on what today’s buyers evaluate most closely, contact us today to refine your listing strategy.

Preparing a home for showings is not about perfection. It is about presentation. Buyers form impressions quickly, often within minutes of walking through the front door. A properly prepared home allows buyers to imagine themselves living there without distraction. Strategic preparation increases perceived value, shortens time on market, and strengthens negotiating power.

Preparing a home for showings is not about perfection. It is about presentation. Buyers form impressions quickly, often within minutes of walking through the front door. A properly prepared home allows buyers to imagine themselves living there without distraction. Strategic preparation increases perceived value, shortens time on market, and strengthens negotiating power. Setting the right price at the start of a listing is one of the most important decisions a seller will make. Many homeowners believe they should price high and negotiate down, but that strategy can backfire. Today’s buyers are informed, analytical, and quick to compare properties.

Setting the right price at the start of a listing is one of the most important decisions a seller will make. Many homeowners believe they should price high and negotiate down, but that strategy can backfire. Today’s buyers are informed, analytical, and quick to compare properties.

Many homeowners assume that a major remodel is the fastest way to increase their sale price. In reality, not every renovation produces a meaningful return. The goal before listing is not to create a dream home, it is to create a market-ready home. Purpose driven updates attract stronger buyers, shorten time on market, and protect your negotiating power. Strategic preparation almost always outperforms emotional renovation.

Many homeowners assume that a major remodel is the fastest way to increase their sale price. In reality, not every renovation produces a meaningful return. The goal before listing is not to create a dream home, it is to create a market-ready home. Purpose driven updates attract stronger buyers, shorten time on market, and protect your negotiating power. Strategic preparation almost always outperforms emotional renovation. Square footage is easy to measure. Community is not, yet it plays a larger role in long term happiness. Buyers often focus on the size of rooms while overlooking the environment surrounding the home.

Square footage is easy to measure. Community is not, yet it plays a larger role in long term happiness. Buyers often focus on the size of rooms while overlooking the environment surrounding the home. Buying a home represents a fresh start, yet many people carry unnecessary clutter into their next chapter. Decluttering before you purchase clarifies what you truly need in a space. It also reduces stress and helps you evaluate homes more realistically. A thoughtful transition supports both short-term organization and long-term satisfaction.

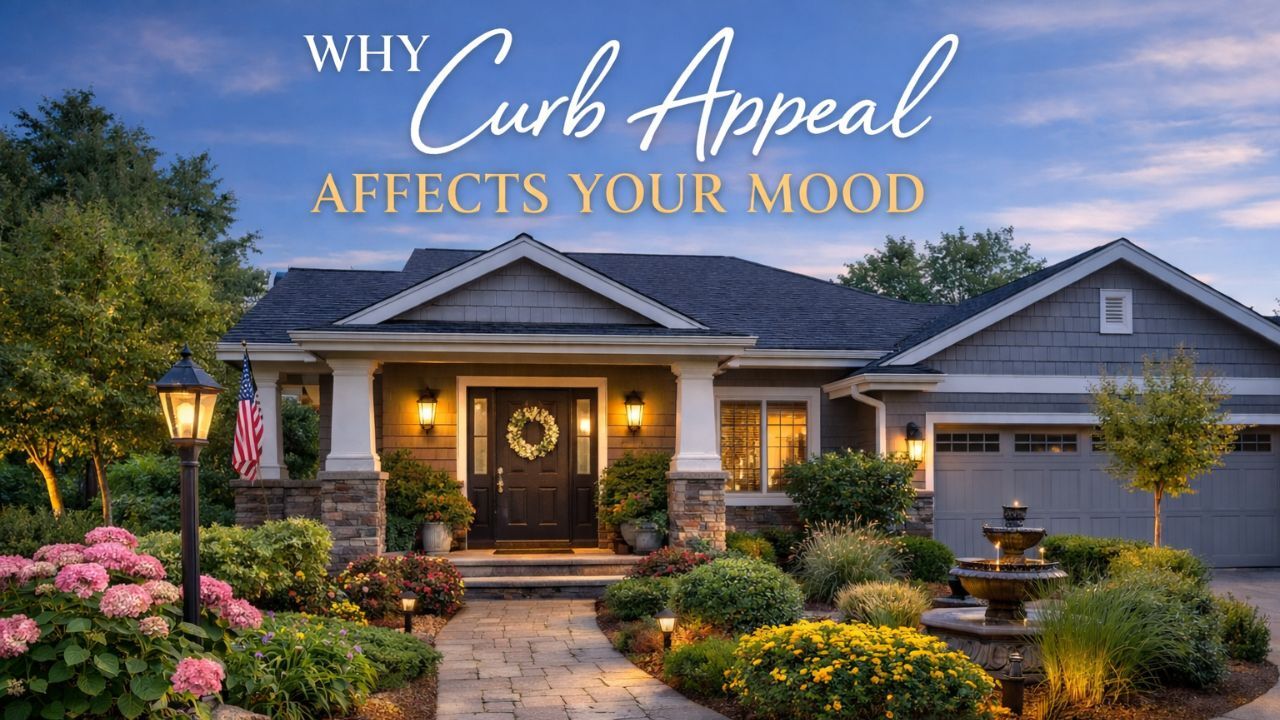

Buying a home represents a fresh start, yet many people carry unnecessary clutter into their next chapter. Decluttering before you purchase clarifies what you truly need in a space. It also reduces stress and helps you evaluate homes more realistically. A thoughtful transition supports both short-term organization and long-term satisfaction. Curb appeal is often described as cosmetic, but its impact goes deeper. The exterior of a home creates an emotional response before you ever step inside. That reaction influences how you feel each time you return home. A well-maintained exterior supports pride of ownership and long-term satisfaction.

Curb appeal is often described as cosmetic, but its impact goes deeper. The exterior of a home creates an emotional response before you ever step inside. That reaction influences how you feel each time you return home. A well-maintained exterior supports pride of ownership and long-term satisfaction.

Choosing a home is not just about the property itself. The surrounding neighborhood will influence your routine, your social life, and your overall satisfaction. Many buyers focus on price and square footage while overlooking how the area aligns with their daily preferences. A neighborhood should reflect your personality and support both your short-term comfort and long-term plans.

Choosing a home is not just about the property itself. The surrounding neighborhood will influence your routine, your social life, and your overall satisfaction. Many buyers focus on price and square footage while overlooking how the area aligns with their daily preferences. A neighborhood should reflect your personality and support both your short-term comfort and long-term plans.